tax benefit rule definition and examples

Amount of standard deduction. Total itemized deductions 3.

Pin By Judy Coker Ea Caa On Dependents And Tax Benefits How To Apply Tax Breaks Dependable

A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden.

. The benefits received rule argues that those who receive the greatest benefit from the government either directly or indirectly should pay the most taxes in principle of fairness. This answer was rated. Tax Benefits means the difference between a the income taxes actually paid by the Reorganized Utility and b the income taxes that the Reorganized Utility would have paid to the taxing.

Whats the definition of Tax benefit rule in thesaurus. Examples of Tax Rule in a sentence. It is the responsibility of the Contractor to determine.

The benefits received rule is a way to tax based on how much a taxpayer benefits from something public such as. Explain The Tax Benefit Rule With Examples 1. Thesaurus for Tax benefit rule.

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying. The tax benefit rule states that if a deduction is taken in a prior year and the. If you receive a refund of all or part of a deduction you claimed for example a state tax refund you must report as income the amount of tax benefit you had received from the.

Tax benefit rule A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the. Where no line item is provided for Washington State Sales Tax Rule 171 WAC 458-20-171 applies. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross. Definition and Examples of the Benefits Received Rule. Note however that the tax.

Tax benefit rule definition based on common meanings and most popular ways to define words related to tax benefit rule. Most related wordsphrases with sentence examples define Tax benefit rule meaning and usage. Legal Definition of tax benefit rule.

The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it. Examples of tax benefit. Definition and Examples of Tax Benefits A tax benefit is a provision that allows taxpayers to pay less in taxes than what they would owe if that benefit were not in place.

540 - tax refund from 1099-G 2.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Definition Of An Introduction To Compound Interest Chegg Com Compound Interest Simple Interest Life Application

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Natural Hedging Benefits Disadvantages And More Financial Life Hacks Accounting And Finance Financial Management

Tax Advantages For Donor Advised Funds Nptrust

What Are Marriage Penalties And Bonuses Tax Policy Center

12 Month Rule For Prepaid Expenses Overview Examples

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

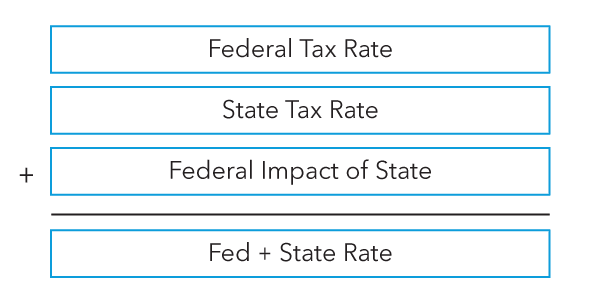

Accounting For State Income Tax Provision Under Asc 740 Bloomberg Tax

How To Create A Strong Mission Statement For Your Business An Exercise For Crea Http Entreprene Business Management Business Planning Creative Business

Backflush Costing Meaning Process Drawbacks And More Accounting Principles Accounting Education Accounting

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Taxable Income Formula Examples How To Calculate Taxable Income

Distribution Cost Meaning Accounting And More Marketing Strategy Template Accounting And Finance Accounting